5 Steps to Tackle Top Payroll Queries in Business

Whether you are part of a small, close-knit group or a big, busy team, it's clear that it's better to handle payments and HR questions from employees in a timely manner. Payroll Queries are inquiries made about the payroll by employees. Businesses need to tackle payroll queries in order to thrive in the field. The year 2024 is the year to bloom in a business by handling payroll related queries better than before. Keep on reading to get comprehensive knowledge on the very same.

What is payroll?

Most of the time, "payroll" means the money that workers get for their work at a company. This includes:

- Salaries

- Wages

- Benefits

- Overtime etcetera

Payroll, which is an investment, is often one of the biggest costs a business has.

What do payroll queries mean?

Payroll Queries may sound like a hard word to say. People have questions

or worries about their paychecks, which are called "payroll queries." Payroll queries are

important because they help make sure that you get paid properly and on time.

Think of them as a way to make sure everything is right. They also let the people in charge

know if there are any problems with your pay. So, they can fix them and make sure everyone

gets the right amount of money for all the hard work they do. So, Payroll Queries are like a

helpful friend who makes sure your paychecks are correct and on the dot.

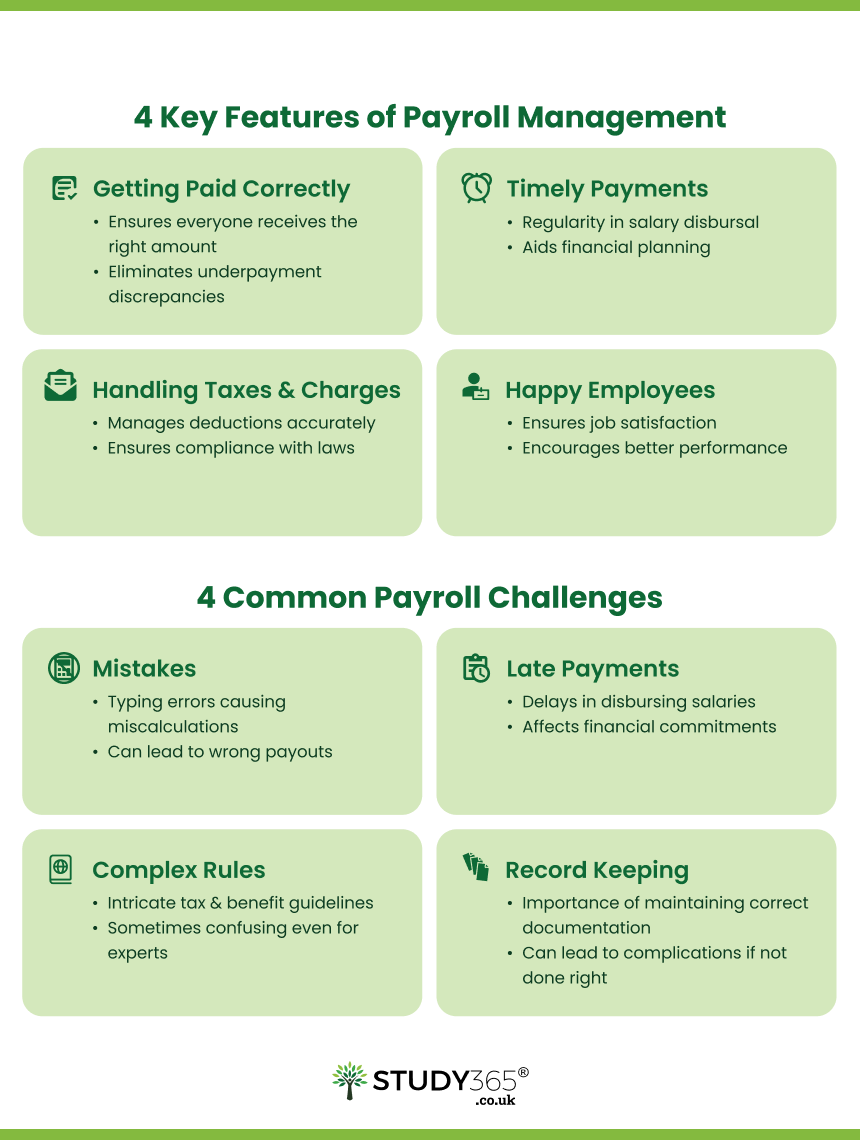

4 Important features of payroll management

- Getting paid correctly: Payroll's main job is to make sure that people get the money they've worked for. Not just getting paid isn't enough; you need to get paid the right amount. Think about how it would feel to work hard all week and then get less money than you should. That wouldn't be fair, and it could cause a lot of trouble.

- On-time payments: Payroll also makes sure that people get their money at the right time. This makes it easier for everyone to plan their spending and meet their wants.

- Taxes and charges: Payroll also handles things like taxes and other charges. Payroll makes sure that the government and other important places get the right amount of money.

- Happy employees: Employees are happy when payroll is handled well. They think that their hard work is being noticed and paid for in a fair way. People who are happy at work are more likely to do a good job.

4 Common challenges

- Mistakes: When figuring out pay, mistakes can happen from time to time. Someone might type in the wrong numbers by mistake, which can lead to wrong paychecks.

- Late payments: Paychecks should be sent out on time, but sometimes they are late. This can be annoying for workers whose bills need to be paid with their paychecks.

- Complex rules: There can be a lot of rules about how much money should be taken out for taxes and other benefits. Even the pros get lost sometimes.

- Keeping records: There is a lot of paperwork and records to keep when it comes to payroll. If these records aren't kept right, it could lead to trouble in the future.

Automation everywhere possible

As your business keeps hiring more and more people, it's important to keep

checking the payroll process. The sooner you get a platform that works better, the sooner you

can use its tools to find any mistakes that could cost you money.

For example, the best option gives a full audit for each quarter, not just for the whole year

and the current quarter. This lets you know about strange changes in data earlier so you can

look into them and take action if you need to.

5 Strategies to handle payroll queries

Effective payroll query management is a mix of:

- Streamlined processes

- Open communication

- Proactive auditing

- Quick resolutions

- Ongoing education

- Streamlined reporting process

- Online portal

- Hotline

- Communication channels

- Regular audits

- Timely resolutions

- Education and training

Setting up a simple way to report is one of the most important things you can do to handle salary questions. This means making sure that workers have a clear and easy way to talk about payroll problems or questions. A clear reporting method makes it easy for employees to talk about problems, whether it's through an:

This step reduces misunderstanding and makes sure that all questions are recorded in a way that makes them easy to solve.

The key to quickly solving payment problems is good communication. Employers should set up clear and easy-to-use ways for workers to ask for help or more information. This could be done through regular emails, HR help desks, or even office hours set aside for payroll-related questions. Clear channels build trust and encourage workers to reach out when they have questions. This makes it less likely that people will misunderstand each other.

Regular payroll checks are necessary to find mistakes and fix them before they become big problems. Payroll records, such as wage calculations, tax withholdings, and benefit deductions, are carefully looked over during these checks. By doing these checks on a regular basis, employers can catch problems early and fix them right away. This not only makes sure that the payroll is done correctly, but also gives employees faith that their problems are being taken seriously.

When it comes to answering questions about wages, it's important to do so quickly. Employees rely on their paychecks to pay for a variety of costs, so any problems or delays can put them in a tough financial situation. Employers should promise to answer questions quickly to show that they care about their employees' well-being. Timely solutions also keep problems from getting worse, which keeps a good work atmosphere and makes HR and payroll departments' jobs easier.

Investing in training and education is a smart way to keep salary questions to a minimum. Many common questions can be answered ahead of time by giving workers clear information about their pay structure, how taxes are taken out, and benefits. Also, if payroll staff is trained on the latest rules and best practises, they will be able to handle complicated questions when they come up. To keep up with changing payroll standards, it's important to keep learning and growing.

Enhancing payroll accuracy

Technology is a key part of making payroll more accurate because it automates processes, makes it possible to:

- Analyse data

- Ensures compliance

- Builds trust among workers

Businesses can also stay in line with labour laws, tax rules, and other legal requirements with the help of technology.

It's also important to build trust with workers because technology makes it easy for them to get pay information, make payments on time and accurately, talk to the payroll department, use self-service portals, and get training and help. Implementing and using the right technology solutions can greatly cut down on mistakes, improve efficiency, and help both employers and workers have a good experience with payroll.

How study365 fit in?

- Courses taught by experts: Study365 has a wide range of payroll courses taught by experts in the field. You'll learn from professionals who know how complicated it is to run a payroll.

- Stay up to date on payroll laws: Rules and regulations about payroll are always changing. The courses on Study365 are meant to keep you up to date on the latest legal requirements. This makes sure that your payroll processes are legal and accurate.

- Improve your job: In today's job market, it's very helpful to know a lot about salary. Whether you want a new job or a promotion, Study365 can help you learn how to handle payroll. This can lead to exciting possibilities.

- Flexible learning: Study365's online programme lets you learn at your own pace, making it easy to balance your studies with work and other obligations. You are free to study whenever and wherever works best for you.

- Practical knowledge: The courses on Study365 are meant to give you hands-on, practical knowledge that you can use right away at your job. Get the confidence you need to manage payroll well and quickly.

Invest in your future and enrol today for our most reputable courses at Study365. Given below are few of the courses you should get your hands on:

- 50c Computerised Payroll (Level 1)

- 50c Computerised Payroll (Level 2)

- 50c Computerised Payroll (Level 3)

In conclusion, tackling top payroll queries in business in 2024 requires a comprehensive approach that combines:

- Understanding

- Strategies

- Commitment to accuracy

Payroll Queries are questions and concerns that employees have about their paychecks. They are important because they make sure that employees are paid properly and on time. They also give companies a way to find out about problems with payroll and deal with them.

These queries often arise due to:

- Human errors

- Misunderstandings

- Complex regulations

Last but not least, Enhancing Payroll Accuracy involves using technology to simplify calculations, employing data analytics for error detection, adhering to compliance rules, and building employee trust through accurate and consistent payroll practices. These steps collectively ensure that payroll runs smoothly, supporting and strengthening employee satisfaction and organizational trust as we step into 2024.

FAQs

Related Products

>Leave a Message

Leave a Message

YOUR EMAIL ADDRESS WILL NOT BE PUBLISHED. REQUIRED FIELDS ARE MARKED.